Summary

We can't have broad adoption of verifiable credentials until we find a way to scale their presentation by providing tooling that credential verifiers can use to reduce their risk and gain confidence in the facts presented to them.

When I hand a merchant in London a piece of plastic that I got from a bank in Utah to make a purchase, a tiny miracle happens. Despite the fact that the merchant has never met me before and has no knowledge of my bank, she blithely allows me to walk out of the store with hundreds of dollars of merchandise, confident that she will receive payment. I emphasized the word confident in the last sentence because it's core to understanding what's happened. In the past, these kinds of transactions required that the merchant trust me or my bank. But in the modern world, trust has been replaced by confidence.

We often mix these concepts up and I'm as guilty as anyone. But trust always involves an element of risk, whereas confidence does not. These are not binary, but rather represent a spectrum. In the scenario I paint above, the merchant is still taking some risk, but it's very small. Technology, processes, and legal agreements have come together to squeeze out risk. The result is a financial system where the risk is so small that banks, merchants, and consumers alike have confidence that they will not be cheated. There's a name in the financial services industry for the network that reduces risk so that trust can be replaced with confidence: an acceptance network.

Acceptance Networks

An acceptance network is the network of merchants or service providers that accept a particular form of payment, usually credit or debit cards, from a particular issuer or payment network. The term refers to a broad ecosystem that facilitates these transactions, including point-of-sale terminals, online payment gateways, and other infrastructure. Each component of the acceptance network plays a crucial role in ensuring that transactions are processed efficiently, securely, and accurately. This drives out risk and increases confidence. Acceptance networks are foundational components of modern payment ecosystems and are essential to the seamless functioning of digital financial transactions. Visa, Mastercard, American Express, and Discover are all examples of acceptance networks.

Before the advent of acceptance networks, credit was a spotty thing with each large merchant issuing it's own proprietary credit card—good only at that merchant. My mom and dad had wallets full of cards for JC Penney, Sears, Chevron, Texaco, and so on. Sears trusted its card. Chevron trusted its card. But it was impossible to use a Chevron card at Sears. They had limited means to verify if it was real and no way to clear the funds so that Chevron could pay Sears for the transaction.

That scenario is similar to the state of digital identity today. We have identity providers (IdPs) like Google and Apple who control a closed ecosystem of relying parties (with a lot of overlap). These relying parties trust these large IdPs to authenticate the people who use their services. They limit their risk by only using IdPs they're familiar with and only accepting the (usually) self-asserted attributes from the IdP that don't involve much risk. Beyond that they must verify everything themselves.

Fixing this requires the equivalent of an acceptance network for digital identity. When we launched Sovrin Foundation and the Sovrin network1 in 2016, we were building an acceptance network for digital identity, even though we didn't use that term to describe it. Our goal was to create a system of protocols, processes, technology and governance that would reduce the risk of self-sovereign identity and increase confidence in an identity system that let the subjects present verifiable credentials that carried reliable attributes from many sources.

I've written previously about identity metasystems that provide a framework for how identity transactions happen. Individual identity systems are built according to the architecture and protocols of the metasystem. Acceptance networks are an instantiation of the metasystem for a particular set of users and types of transactions. A metasystem for self-sovereign identity might have several acceptance networks operating in it to facilitate the operation of specific identity systems.

Problems an Acceptance Network Can Solve

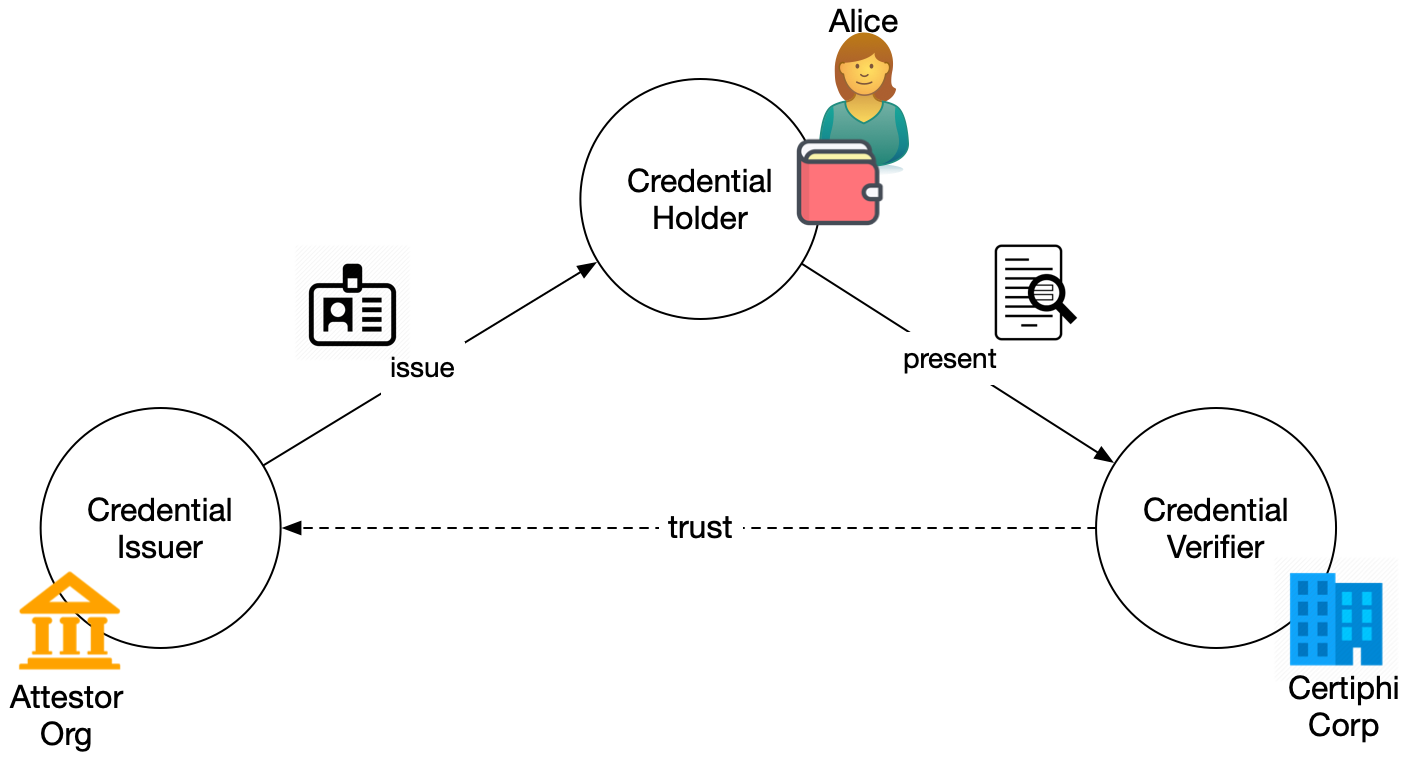

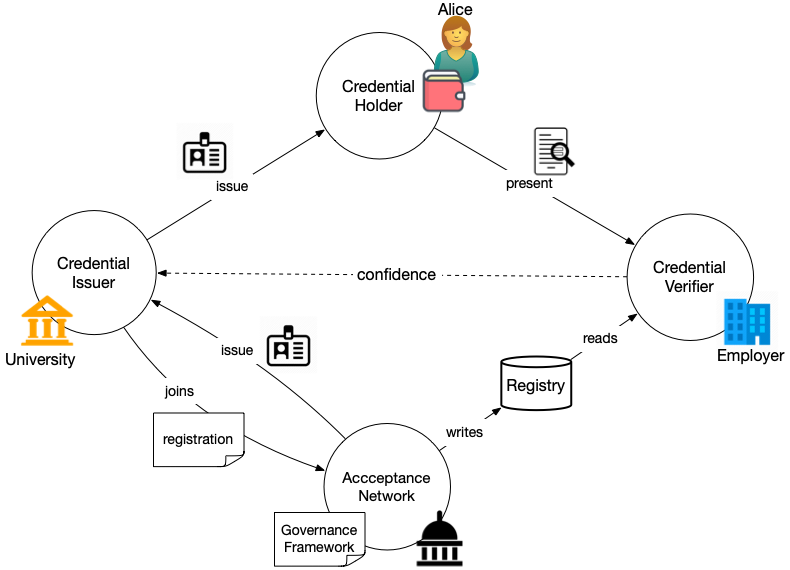

To understand why an acceptance network is necessary to reduce risk and increase confidence in identity transactions, let's explore the gaps that exist without it. The following diagram shows the now familiar triangle of verifiable credential exchange. In this figure, issuers issue credentials to holders who may or may not be the subject of the credentials. The holder presents cryptographic proofs that assert the value of relevant attributes using one of more of the credentials that they hold. The verifier verifies the proof and uses the attributes.

Let's explore what it means for the verifier to verify the proof. The verifier wants to know a number of things about the credential presentation:

- Were the credentials issued to the entity making the presentation?

- Have any of the credentials been tampered with?

- Have any of the credentials been revoked?

- What are the schema for the credentials (to understand the data in them)?

- Who issued the credentials in the proof?

The first four of these can be done cryptographically to provide confidence in the attestation. The technology behind the credential presentation is all that's necessary. They can be automated as part of the exchange. For example, the proof can contain pointers (e.g., DIDs) to the credential definitions. These could contain public keys for the credential and references to schema.

The last one—who issued the credential—is not a technical matter. To see why, imagine that Alice (as holder and subject) has been issued a credential from her university (the issuer) giving information about her educational experiences there. She's applying for a job and wants to present the credential to a prospective employer (the verifier). How does the employer know that Alice didn't just make the credential herself or buy it from a diploma mill?

Knowing who issued the credential is not something that can be done solely with technology (although it can help). The employer in this scenario wants more than an identifier for the issuer. And they want to know that the public key really does belong to the university. In short, the employer wants to resolve the identifier to other information that tells them something about the university and the credential. There are lots of ways to do that—people have been doing this sort of thing for centuries: states keep registries of businesses (universities are businesses), accreditation organizations keep registries of schools they've accredited, the Department of Education has registries of various institutions of higher education in the US, and so on.

The employer could make use of these by building its own database of university identifiers it trusts. And every time a new one shows up, they could investigate and add it to their registry (or not)2. But going back to the magic of the credit card scenario that I opened this article with, if every merchant had to keep their own registry of banks, the experience wouldn't be magical for me or the merchant. The financial acceptance network makes it easy for the merchant to have confidence that they'll be paid because they have not only technology, but processes, protocols, governance, and legal agreements that make the verification process automatable.

Acceptance Networks for Digital Identity

For some use cases, keeping your own registry of the issuers you trust works. But for many, it's just too much work and makes it difficult to make use of a variety of credentials. This kind of "localized trust" is unwieldy in an identity system that might involve millions of issuers and identifiers and credentials for billions or even trillions of subjects. I've written extensively about identity metasystems and what they provide to help bridge the gap. This one, on how metasystems help provide life-like identity for digital systems is perhaps the most comprehensive. Acceptance networks implement metasystems.

An acceptance network for digital identity must have a number of important properties, including the following:

Credentials are decentralized and contextual—There is no central authority for all credentials. Every party can be an issuer, a holder (identity owner), or a verifier. Verifiable credentials can be adapted to any country, any industry, any community, or any set of trust relationships.

Credential issuers decide on what data is contained in their credentials—Anyone can create a credential schema for their use case. Anyone can create a credential definition based on any of these schemas.

Verifiers make their own trust decisions about which credentials to accept—There's no central authority who determines what credentials are important or which are used for what purpose. The acceptance network supplies the technical underpinnings for credential exchange and support protocols for automating the verification of credential issuers.

Credential verifiers don't need to have any specific technical, contractual, or commercial relationship with credential issuers—Verifiers do not need to contact issuers to perform verification.

Credential holders are free to choose which credentials to carry and what information to disclose—People and organizations are in control of the credentials they hold (just as they are with physical credentials) and determine what to share with whom.

You may be thinking "but these are mostly about decentralized decision making." While it would be easier to imagine the acceptance network as a big directory, that solution can't possible support all the different ways people and organizations might want to use credentials. That doesn't mean an acceptance network couldn't be run by a single organization, like some financial services networks. Just that it has to support a variety of credential ecosystems running common protocols. I also think that there will be more than one and most issuers and verifiers will be part of several (again, like in financial services).

Structure of an Acceptance Network

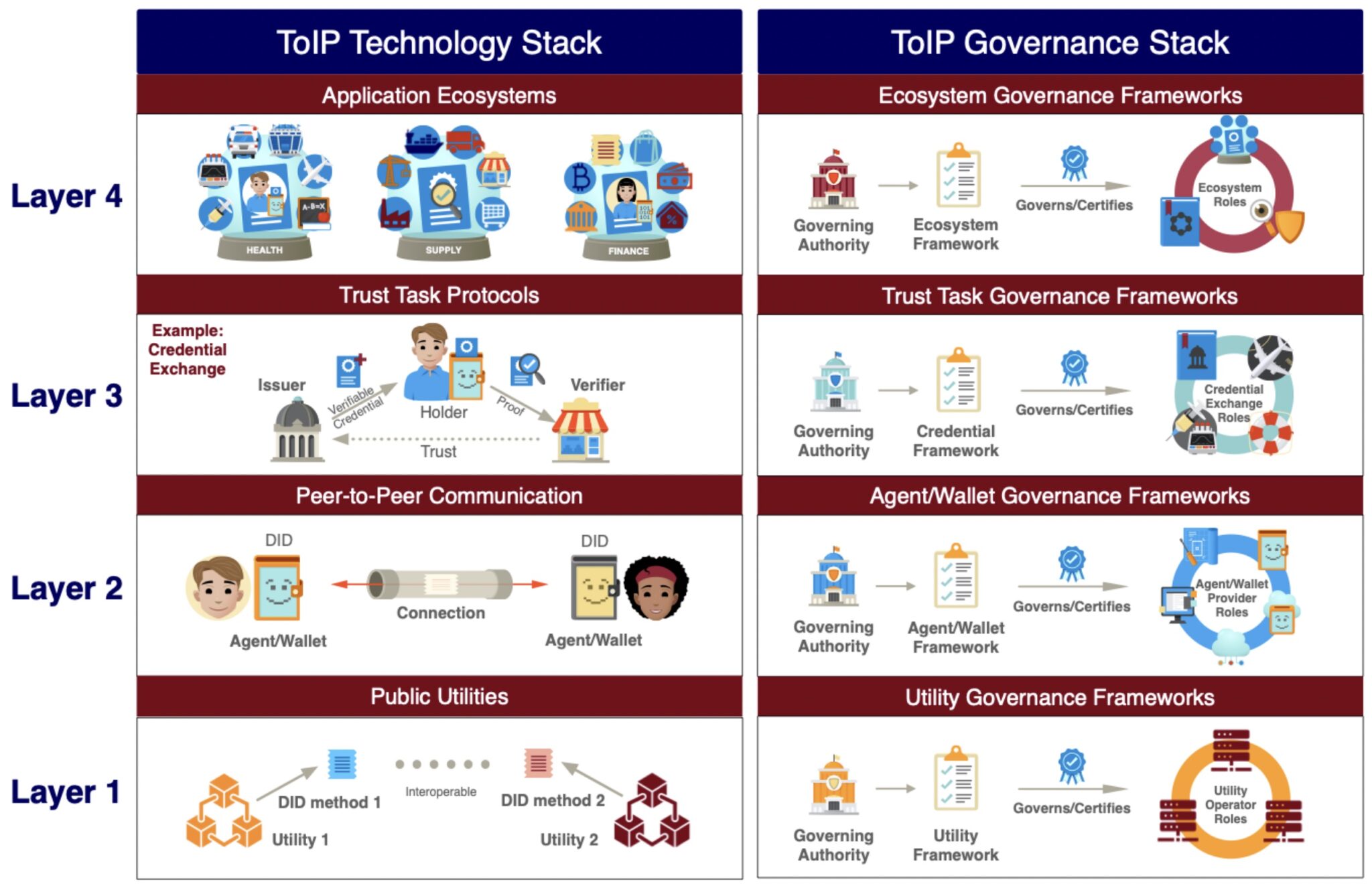

One of the things we can take away from the architecture of financial services acceptance networks is that they are built in layers. No one has thought more about how this can work than Drummond Reed and the Trust Over IP Foundation (ToIP).3 This figure, from ToIP, shows how such a stack works.

The layers build on each other to provide something the lower level didn't. Layer 1 is the foundational functionality, like DID methods. Layer 2 builds on that to support creating digital relationships with anyone. Layer 3 uses those relationships to effect credential exchange. Layer 4 is the ecosystems that say things about the issuers for different use cases. The dual stack emphasizes the need for governance at every layer.

The acceptance network specifies the accepted protocols and technologies. The acceptance network also supports ecosystems, providing governance models and technology. The acceptance network is involved at each layer. Here are some examples of things an acceptance network might do at each layer:

- Layer 1—limit the allowed DID methods and certify them.

- Layer 2—require that wallets and agents using the network support specific versions of the DIDComm protocol. Provide a certification framework for wallet and agent vendors for security and interoperability.

- Layer 3—require specific versions of the exchange protocols. Participate in protocol development. Provide a certification framework for specific implementations to aid with security and interoperability.

- Layer 4—support the formation, certification, and discovery of credential ecosystem providers. Govern what is required to be a certified ecosystem provider and provide models for acceptable ecosystem governance.

As part of it's overall governance of the ecosystem, the acceptance network also provides model legal agreements for and between the various participants, trust mark rights (think of the Visa logo), and drives a uniform user experience.

The following diagram shows the credential exchange from the preceding figure with an acceptance network providing support to the verifier so that it can have confidence in the data the issuer has supplied through the holder.

Credential issuers who know their credential might be widely used would join one or more acceptance networks. They agree to follow the rules and regulations in the governance framework of the acceptance network. The acceptance network issues a credential to them that they can use to prove they are a member.4 The acceptance network maintains a registry—likely a registry of registries—that verifiers can use to discover information about the issuer of a credential that has been presented to them.

Using an Acceptance Network

Returning to our previous scenario, Alice holds a credential issued by her university. She presents it to a prospective employer who wants to know that the credential is from an accredited university. Alice's university has been accredited by an accreditation organization5. They have followed their process for accrediting Alice's university and issued it a credential. They have also added the university to their registry. The university and the accrediting organization are members of an acceptance network. The employer's systems know to automatically query the acceptance network when it received a credential proof from a issuer it does not know. Doing so provides the assurance that the issuer is legitimate. It could also provide information about the accreditation status of the university. This information reduces the risk that the employer would otherwise bear.

In this scenario, the employer is trusting the processes and structure of the acceptance network. The employer must decide which acceptance networks to use. This is much more scalable than having to make these determinations for every credential issuer. The acceptance network has allowed the verification process to scale and made the overall use of verifiable credentials easier and less risky.

A Note on Implementation

This discussion of acceptance networks has undoubtedly brought images to your mind about how it is structured or how to build one. The comparison to financial services acceptance networks points to a network run by an organization. And the term registry brings to mind a database of some kind. Why these are certainly possibilities, I think it's also possible to imagine more decentralized solutions. For example, the registry could be a distributed ledger or blockchain. The governance is likely most easily done by an organization, but there are other options like a decentralized autonomous organization (DAO). The scenario I described above illustrates a federated system where certifying authorities for specific ecosystems determine their own methods, processes, and requirements, but link their registry to that of the acceptance network.

Conclusion

As I mentioned above, we've been solving the problem of how to know which institutions to trust for centuries. We have ways of knowing whether a university is accredited, whether a bank is real, whether a company is actually registered and what its reputation is. What is missing is an easy way to make use of this information digitally so that processes for reducing risk can be automated. Acceptance networks rationalize the process and provide the needed tooling to automate these checks. They reduce the many-to-many problem that exists when each verifier has to determine whether to trust each issuer with a more scalable many-to-several system. Acceptance networks allow credential presentation to scale by providing the needed infrastructure for giving verifiers confidence in the facts that holders present to them.

Notes

- You can see in the linked post how we used trust to describe what we were building, even as we were reducing risk and inspiring confidence.

- Note that this investigation could make use of technology. Knowing the universities name, they could look up a well known location on the universities web site to find the identifier. They could use PKI (digital certificates) to be sure they're talking to the right place. They could look up the university in an online registry of accredited universities.

- Trust over IP isn't the only one working on this. Marie Wallace of Accenture and Stephen Wilson of Lockstep Partners have been writing about this idea.

- Note that there could be different levels or types of members who perform different roles in the ecosystem and make different agreements.

- An example is the Northwest Commission on Colleges and Universities.

Photo Credit: Data flowing over networks from DALL-e